What happens if an approval resolution of share transfer is rejected?

When you want to transfer your shares, generally, it requires you to get prior approval from the appropriate authorities of private companies. By knowing about this fact, the next question that would arise in your mind is “What happens in the unlikely event that the approval resolution is rejected?”.

There might be a situation, for example, where you want to no longer be a shareholder (owner) of the company, but your co-owners are unlikely to accept your request. In this kind of circumstance, you may think that you would have no choice but to remain a shareholder of the company.

Or, in another situation, for those of you who bought the shares of the private companies may worry whether the transfer is valid or not when the approval resolution is rejected after the contracts have been concluded?

In this article, I will explain the subsequent flow of events if the resolution to approve the stock transfer ends up being rejected.

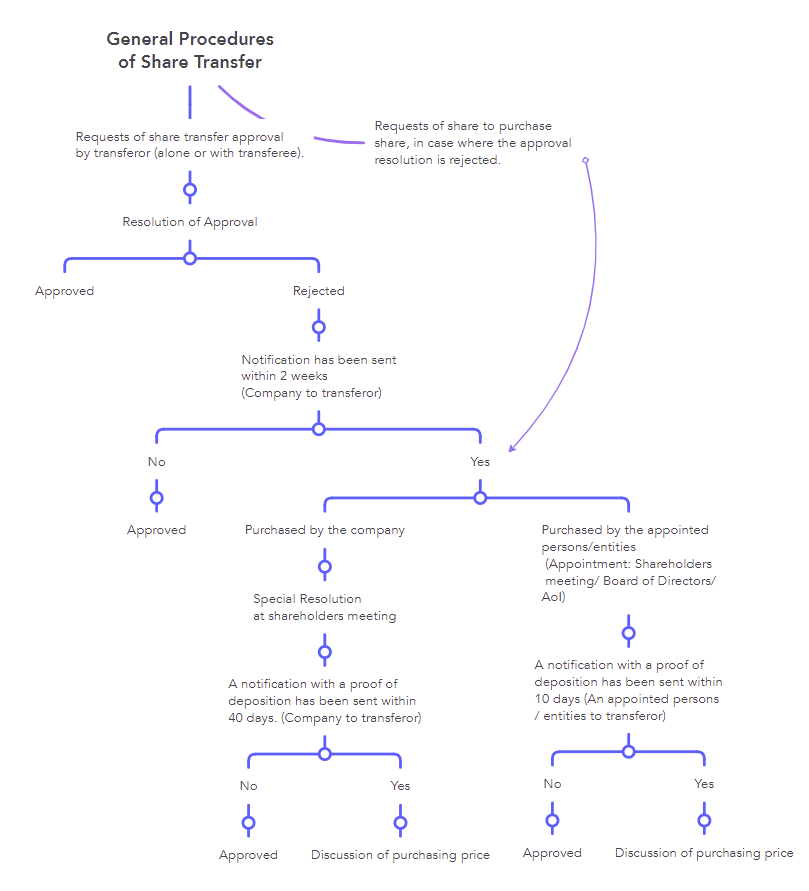

General Procedures of Share Transfers

*An approval resolution is not required for a single shareholder.

Important Points about above flows:

◆ Rejected or not, You can freely let go of your shares

In principle under the Japanese Companies Law, the freedom of transfer of shares is legally ensured.

And the original concept of giving restriction on the share transfer is to give remaining shareholders an opportunity to select their post co-owners.

Therefore, if the transfer would not be approved, then you can request the company to buy the shares, or request the company to find someone else to buy your shares. In most cases, the major shareholders or representative directors would be selected as a buyer, since there are financial resources regulations when the company purchases the shares from their own shareholders.

◆No response from the issuing company.

Even if your share transfer were rejected, deemed approval would be granted if the company had failed to give such notice to the transferor within two weeks from the date of the request.

The reason for this time limit is due to the fact that the law in principle allows freedom of share transfer and tries to protect the rights of the contracting parties as much as possible. Therefore, there is no need to assume that your request has been denied just because you have not received any notice or letter from the company.

What happens if you receive the denial letter after you have concluded the shares transfer agreement?

The above situation could happen when the share transfer agreement is concluded prior to request for getting approval.

In this case, the share transfer will be invalid between the companies, but will be valid between the parties.

Invalid between companies:

It means that the company will not acknowledge the fact that the shares have been transferred. As a consequence, the shareholder registry cannot be updated, and the company will treat the transferor (who’s name is on the current shareholder registry) as their true and legitimate shareholders.

Valid between the parties:

Since the transferee has no longer been able to exercise his/her/entities rights, they can claim the lost profits to the transferor. For example, if the dividends will be paid from the company to the transferor after the transfer date, then the transferee can file a claim for redemption against the transferor.

Be careful not to forget to update the shareholders registry

The share transfer approval resolution and the shareholders registry update are always performed as a set. If a shareholder forgets to request the company to update him/her after the approval of the transfer, the company may treat the person on their registry as a current shareholder, so the dividend may still be paid to the transferor.

Difference between failure of rewriting the shareholder registry and a denial of approval of share transfer.

In the former case, the company is allowed to treat the transferee as a shareholder at its discretion.

Note: On the other hand, the transferee cannot assert his/her rights against the company because they can simply request the company to update the shareholders registry, instead.

In the latter case, the company is not allowed to treat the transferee as a shareholder. This is because the transfer of shares is invalid for the company; meaning that there were no share transferred that they recognize.

Conclusion

Even though your request of share transfer may be denied, you can still sell your shares by either demanding a company to buy your shares or by making company to appoint someone else to purchase your shares.

Also, if the agreement of the share transfer is concluded, but is denied by the approval authority, then those transfer will take effect between the parties, but not between the company. So the transferor may have to take responsibility if there are some loss occurred to the transferee due to the transfer.

My recommendation to avoid such problems, is to better to enter into the agreement after or at the same date of the approval resolution if possible, or to make the approval resolution as a condition precedent to such transfer.

Also, once you have completed the share transfer procedures, be sure to request a update of the shareholder registry because the company would not naturally rewrite the shareholder registry just because they have passed an approval resolution.

The procedure for requesting the update is as follows:

Share Certificates issuance Company: A transferee can make a request by presenting the share certificates to the company

Share Certificates non issuance Company: A transferor and a transferee can make a joint request to the company.

MK@ 04/02/2022

MK @ Legal Biz Leaf

MK @ Legal Biz Leaf