Restrictions on Conflicting Interest Transactions

I sometime receive inquiries from my clients that they would like to “transfer director’s personal property of “something” to the company. This “something” can be his/her real estates, shares, or business (i.e., absorption-type merger), etc.【 Skip to the conclusion 】

Buying the real estate, for example, from a director may be easier and safer than for the company to search it by themselves and thus matches with their interests. On the other hand, in such cases, there is a risk that the director may use his/her position to make the company to purchase the assets at an unreasonably high price. Therefore, the Companies Act stipulates that a prior approval resolution must be passed when a director directly or indirectly enters into a transaction with the company.

Scope of “Conflict of Interest Transactions”

There are two types of transactions that are considered to be a conflict of interest transactions: 1. Direct Transactions and 2. Indirect Transactions.

1. Direct Transactions

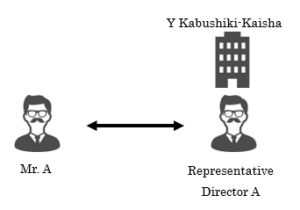

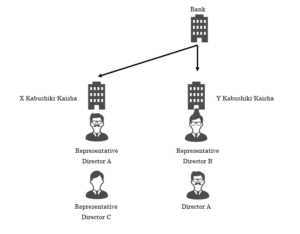

A direct transaction is a transaction (e.g., a sale, purchase, loan, exemption of the payment of debt, etc.) done directly between the company an individual director (or a separate company of which the individual director is the Representative Director), as shown in the diagram below.

*Even if Mr. A is an ordinary director of the Y Kabushiki-Kaisha, an approval is required.

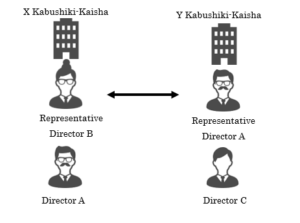

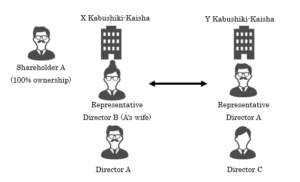

X Kabushiki-Kaisha: Regarded as a conflict of interest transaction; thus, approval resolution is required)

Y Kabushiki-Kaisha: Not regarded as a conflict of interest transaction; thus, approval resolution is not required.

* If it is difficult to judge, it might be easier to understand from the viewpoint of “whether the representative director of the other company named in the contract, exists as the company’s current directors or not”.

With above case, it can be seen that it is A who has substantial control over X Kabushiki-Kaisha, although he is not in a position of a Representative Director. In such case, the judgement of whether or not an approval resolution at Y Kabushiki-Kaisha is required are differ depending on the judicial precedent and there are not a clear standard.

Therefore, if there is any doubt as to whether a transaction involves a conflict of interest, it is recommended to obtain a prior approval resolution in order to avoid trouble.

2. Indirect Transactions

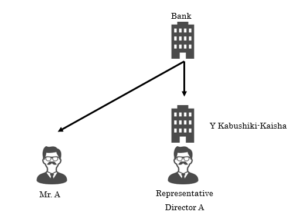

An indirect transaction is a transaction which a company guarantees the debt of an individual director (or a separate company of which the individual director is the Representative Director) or set a security interest in the company’s real estate for the benefit of the director, as shown in the diagram below.

In order to guarantee the debt of X Kabushiki-Kaisha (with a Representative Director A), an approval resolution is required at Y Kabushiki Kaisha (with a Director A).

In the case of an indirect transaction, an approval resolution is required at Y Kabushiki-Kaisha even if the contractor at X Kabushiki-Kaisha is Representative Director C.

If it is difficult to judge, it might be easier to understand from the viewpoint of “whether the representative director listed in the corporate registration of the company to be guaranteed (primary obligor) exists as the company’s current directors or not”

The cases which an approval resolution is not required

If it is clear that the company will not at risk of any disadvantages, an approval resolution is unnecessary.

For Example:

1. When a company receives a gift or an interest-free, unsecured loan from a director

2. When a single director and sole shareholder is the same person, or when consents of all shareholders are obtained

3. When a director set off an obligation (e.g., Offsetting a director’s remuneration claim against and a loan from the company)

4. When concluding an agreement on standard terms of contract(= there is no room for a director to interfere with the interests of the company at his/her own discretion). e.g., concluding the transaction of a director liability insurance policy

Approval authorities and participation in the resolution

Approval must be obtained from the following approval authorities with disclosing specific details of the transaction such as a name of the counterparty, contents of goods and services, quantity, price, etc.

If there are ongoing or periodic sales contracts, it is also possible to obtain comprehensive approval by specifying the period, limits of price, etc.

Companies with a Board of Directors: Board of Directors

Prior approval shall be obtained and the result must be reported.

The director concerned cannot participate in the approval resolution as he/she is an interested party. It is advisable for the director to refrain from assuming the position of chairman of the meeting, and leave the room when the resolution is to be made (he/ she may participate in other resolutions before/after the resolution).

Companies without a Board of Directors: General meeting of shareholders

Prior approval shall be obtained; no post-event report is required.

The director concerned is allowed to participate in the resolution “as a shareholder”. It is also possible for a director to assume the position of chairman, but it is safer to have someone else assume the position to avoid the possibility of questions arising later.

*In the event that prior approval cannot be obtained, the post-approval is also valid.

Failure to Obtain Approvals and Company Damages

When a transaction is concluded without an approval, the company may claim that the transaction is invalid. However, especially in the case of indirect transactions, the company cannot claim invalidity against a bona fide third party; in order to do so, the company must prove that the third party knew the fact that he/she did not obtained the approval.

*The director cannot claim invalidation of the transaction.

In the case of a transaction involving a conflict of interest, even if the prior or subsequent approval was obtained, the directors are liable for damages if the company suffers damages as a result. In this case, it should be noted that the liable directors include the persons who voted in favor of (or did not object to) the resolution. However, this excludes cases where there are reasonable grounds to believe that there is no possibility of damage to the company, such as if the pre-disclosed documents submitted by the company have been falsified.

*A director with a conflict of interest who has engaged in the transaction is not exempt from liability for any reason.

Conclusion

- When a director engages in a direct or indirect transaction with the company, it is necessary to obtain prior (or subsequent) approval from the Board of Directors or the general meeting of shareholders.

- An approval does not necessarily mean that the company allows the director to cause damage to the company though the transactions. If the company is damaged as a result, the director in question or directors who agreed to the approval resolution (include tacit approval) are liable for compensation for damages.

- An approval is not required when it is clear that the company will not be disadvantaged.

- Directors who are parties to a conflict of interest shall not participate in the resolution.

- The company may claim an invalidity of a transaction when it has been conducted without their approval. However, such invalidity may not be asserted against a third party a bona fide third party

MK@ 05/26/2022

MK @ Legal Biz Leaf

MK @ Legal Biz Leaf